Pay advances and loan policy (North Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (North Carolina)

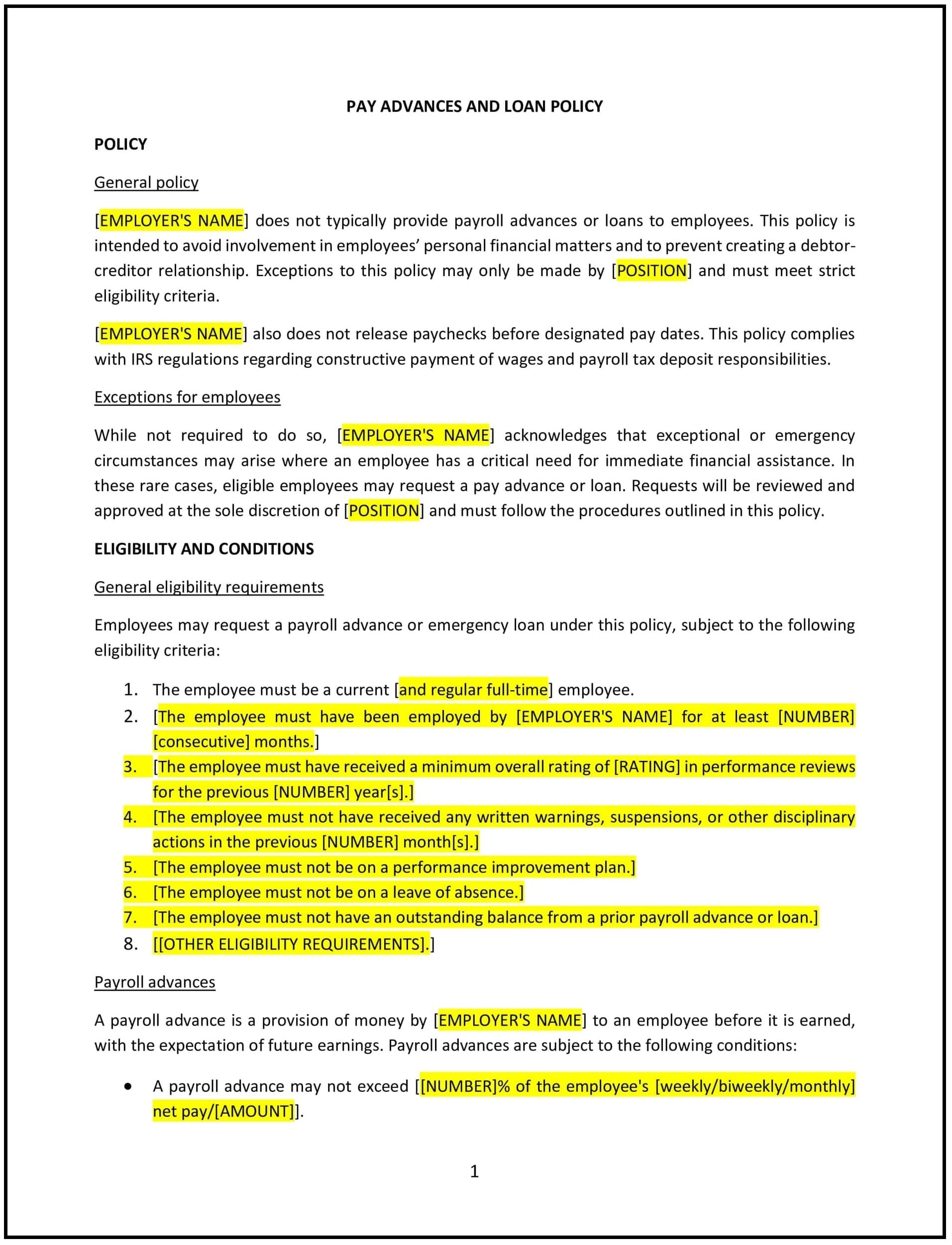

A pay advances and loan policy helps North Carolina businesses establish clear guidelines for offering financial assistance to employees in the form of pay advances or loans. This policy outlines the process for requesting and approving pay advances or loans, as well as the terms of repayment and eligibility criteria. It ensures that employees have access to financial support when needed while protecting the business from financial risk.

By adopting this policy, businesses can help employees manage personal financial challenges without disrupting business operations, while maintaining financial accountability.

How to use this pay advances and loan policy (North Carolina)

- Define eligibility criteria: Specify which employees are eligible for pay advances or loans, such as full-time employees or those who have completed a probationary period.

- Set application procedures: Outline the steps employees must follow to apply for a pay advance or loan, including any required documentation and approval processes.

- Establish loan terms: Clearly define the terms of any loan, such as repayment schedules, interest rates (if any), and any fees associated with the loan.

- Set repayment guidelines: Specify how repayment will be handled, including whether payments will be deducted from future paychecks or if employees are required to make payments through other means.

- Reflect North Carolina-specific considerations: Ensure the policy aligns with North Carolina’s laws on lending, including interest rate restrictions and disclosure requirements for loans to employees.

Benefits of using this pay advances and loan policy (North Carolina)

This policy provides several benefits for North Carolina businesses:

- Supports employee well-being: Offering pay advances or loans helps employees manage financial difficulties, reducing stress and improving overall job satisfaction.

- Maintains financial accountability: A clear policy ensures that any advances or loans are repaid according to agreed-upon terms, protecting the business from financial loss.

- Reduces legal risks: The policy helps businesses comply with North Carolina lending laws, ensuring that pay advances and loans are handled legally and ethically.

- Enhances employee loyalty: Providing financial support during challenging times can increase employee loyalty and reduce turnover.

- Promotes fairness: By clearly outlining eligibility criteria and repayment terms, the policy ensures that all employees are treated equally when requesting financial assistance.

Tips for using this pay advances and loan policy (North Carolina)

- Communicate the policy clearly: Ensure all employees understand the process for applying for pay advances or loans, as well as the eligibility requirements and repayment terms.

- Review loan requests carefully: Review each loan application thoroughly to ensure it is in line with company guidelines and that the employee’s ability to repay is considered.

- Monitor repayment: Track repayments to ensure they are made on time and in accordance with the agreed-upon terms.

- Review the policy regularly: The policy should be reviewed annually to ensure it complies with North Carolina lending laws and reflects the financial needs of employees.