Pay advances and loan policy (Texas): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Texas)

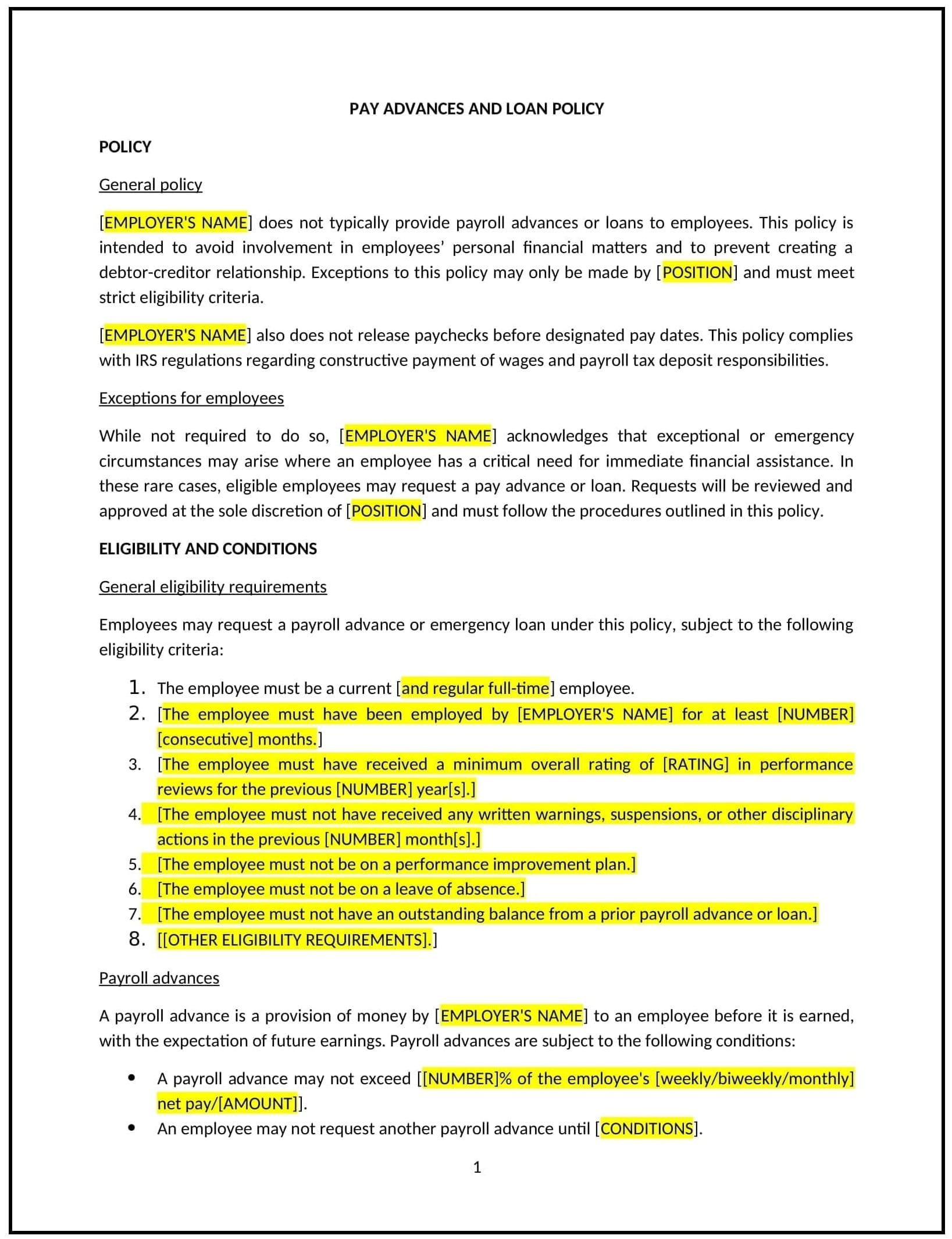

This pay advances and loan policy is designed to help Texas businesses establish clear guidelines for providing pay advances or loans to employees. The policy outlines the company’s approach to handling requests for financial assistance, including the conditions under which advances or loans may be granted, repayment terms, and any associated fees.

By adopting this policy, businesses can ensure transparency, consistency, and fairness in their approach to employee financial assistance, while protecting the company’s financial interests and complying with Texas state laws.

How to use this pay advances and loan policy (Texas)

- Define eligibility: Specify which employees are eligible to receive pay advances or loans, including any criteria such as length of service, job position, or financial need.

- Set conditions for pay advances or loans: Clearly outline the circumstances under which pay advances or loans may be granted, including the maximum amount, frequency, and acceptable reasons for requesting financial assistance.

- Specify repayment terms: Establish clear repayment terms, including the repayment period, the method of repayment (e.g., payroll deductions, lump sum), and the consequences of non-repayment. The policy should also address how the repayment schedule will be adjusted if the employee leaves the company before the loan is fully paid.

- Address interest rates and fees: If applicable, specify any interest rates or fees associated with the loan. Texas state law may regulate interest rates and fees for certain types of loans, so ensure the policy is compliant with applicable regulations.

- Outline approval process: Provide clear guidelines for the approval process, including who within the company has the authority to approve or deny requests for pay advances or loans, and what documentation is required.

- Protect confidentiality: Ensure that employee requests for pay advances or loans are handled confidentially and that financial assistance is granted without discrimination or bias.

- Address impact on employee benefits: Specify whether pay advances or loans will affect employee benefits or bonuses, and clarify if the employee’s loan repayment will be deducted from their paycheck before or after taxes.

Benefits of using this pay advances and loan policy (Texas)

This policy offers several benefits for Texas businesses:

- Promotes fairness and transparency: By setting clear guidelines for pay advances and loans, businesses ensure that all employees are treated consistently and fairly when requesting financial assistance.

- Reduces financial risk: Establishing clear repayment terms, interest rates, and fees helps businesses manage the financial risk associated with providing loans or pay advances to employees.

- Supports employee retention: Offering financial assistance can improve employee satisfaction, reduce stress, and promote retention, especially during times of personal financial hardship.

- Enhances compliance: The policy helps promote compliamce with Texas state laws and federal regulations regarding pay advances, loans, and interest rates, reducing the risk of legal issues.

- Improves communication: The policy clarifies the company’s expectations and processes related to financial assistance, making it easier for employees to understand the terms and conditions of the support offered.

Tips for using this pay advances and loan policy (Texas)

- Communicate the policy clearly: Ensure that all employees are aware of the policy and understand the eligibility requirements, application process, and terms of any loans or pay advances offered. This can be included in the employee handbook or communicated through HR.

- Monitor repayment: Keep track of all pay advances and loans granted to employees to ensure that repayments are being made according to the agreed terms.

- Handle requests promptly: Ensure that requests for pay advances or loans are processed in a timely manner to provide financial relief when needed.

- Be consistent: Apply the policy consistently across all employees, ensuring that decisions regarding loans or pay advances are made fairly and without favoritism.

- Review regularly: Periodically review and update the policy to ensure it is compliant with Texas state laws, federal regulations, or changes in company practices regarding pay advances and loans.