US export and trade compliance policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

US export and trade compliance policy (New York)

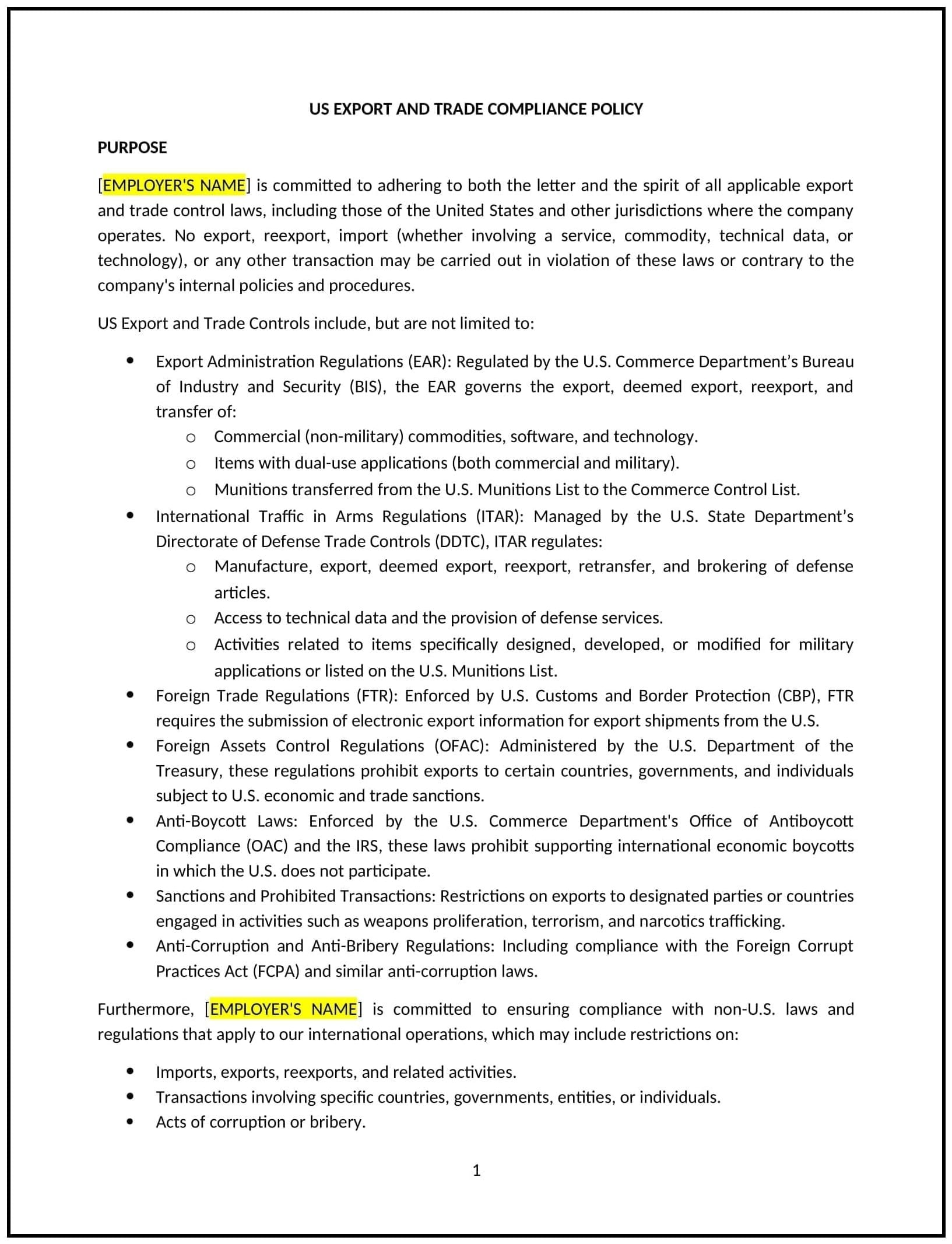

This US export and trade compliance policy is designed to help New York businesses establish clear guidelines for adhering to US export laws and trade regulations. Whether businesses are involved in exporting goods, services, or technology, this template provides a structured approach to managing export controls, supporting compliance with federal regulations such as the Export Administration Regulations (EAR) and the International Traffic in Arms Regulations (ITAR).

By adopting this template, businesses can minimize legal risks, ensure compliance with export laws, and safeguard the organization from potential penalties.

How to use this US export and trade compliance policy (New York)

- Define compliance obligations: Clearly specify the legal requirements related to exporting products, technology, or services, including the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and economic sanctions.

- Outline approval processes: Establish a process for obtaining the necessary licenses or authorizations from the Bureau of Industry and Security (BIS) or the Directorate of Defense Trade Controls (DDTC) when required.

- Address restricted parties: Define procedures for screening customers, suppliers, and business partners against government lists of restricted parties or entities, such as the Entity List and Specially Designated Nationals (SDN) list.

- Set guidelines for record-keeping: Ensure businesses maintain accurate records of all exports, licenses, and communications related to trade transactions, as required by federal law.

- Establish training and monitoring: Provide regular training for employees involved in export activities and establish mechanisms for ongoing monitoring of compliance with the policy.

Benefits of using this US export and trade compliance policy (New York)

This policy offers several benefits for New York businesses:

- Reduces legal risks: A well-defined compliance policy helps businesses avoid violations of export control laws, which could result in fines, sanctions, or loss of export privileges.

- Ensures smooth operations: A clear understanding of export regulations enables businesses to navigate the complexities of international trade without unnecessary delays or compliance issues.

- Protects business reputation: Maintaining compliance with US export laws helps protect the company’s reputation as a responsible global business partner.

- Improves risk management: By screening business partners and maintaining proper records, businesses can mitigate the risks associated with trading with restricted or unlicensed entities.

- Promotes operational efficiency: Regular training and monitoring help ensure that employees understand their compliance responsibilities, reducing the likelihood of errors and inefficiencies.

Tips for using this US export and trade compliance policy (New York)

- Communicate clearly: Ensure that all employees involved in export activities understand the policy and the legal requirements associated with their roles.

- Monitor compliance: Regularly review export transactions, licenses, and partner relationships to ensure adherence to export control laws and company policy.

- Conduct training: Offer regular training sessions to employees on export regulations, including updates to the EAR, ITAR, and sanctions programs.

- Use compliance tools: Implement tools to help screen customers, suppliers, and business partners against restricted lists and facilitate the approval process for licenses.

- Review regularly: Update the policy periodically to reflect changes in federal export regulations, changes in business operations, or New York state law.