Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free fraud-detection system proposal with Cobrief

Open this free fraud detection system proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on company size, risk profile, industry, and data maturity. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching fraud-detection solutions to finance, compliance, or engineering leaders. Whether you're recommending a new tool, building custom logic, or tightening controls, this version gives you a structured head start and removes the guesswork.

What is a fraud detection system proposal?

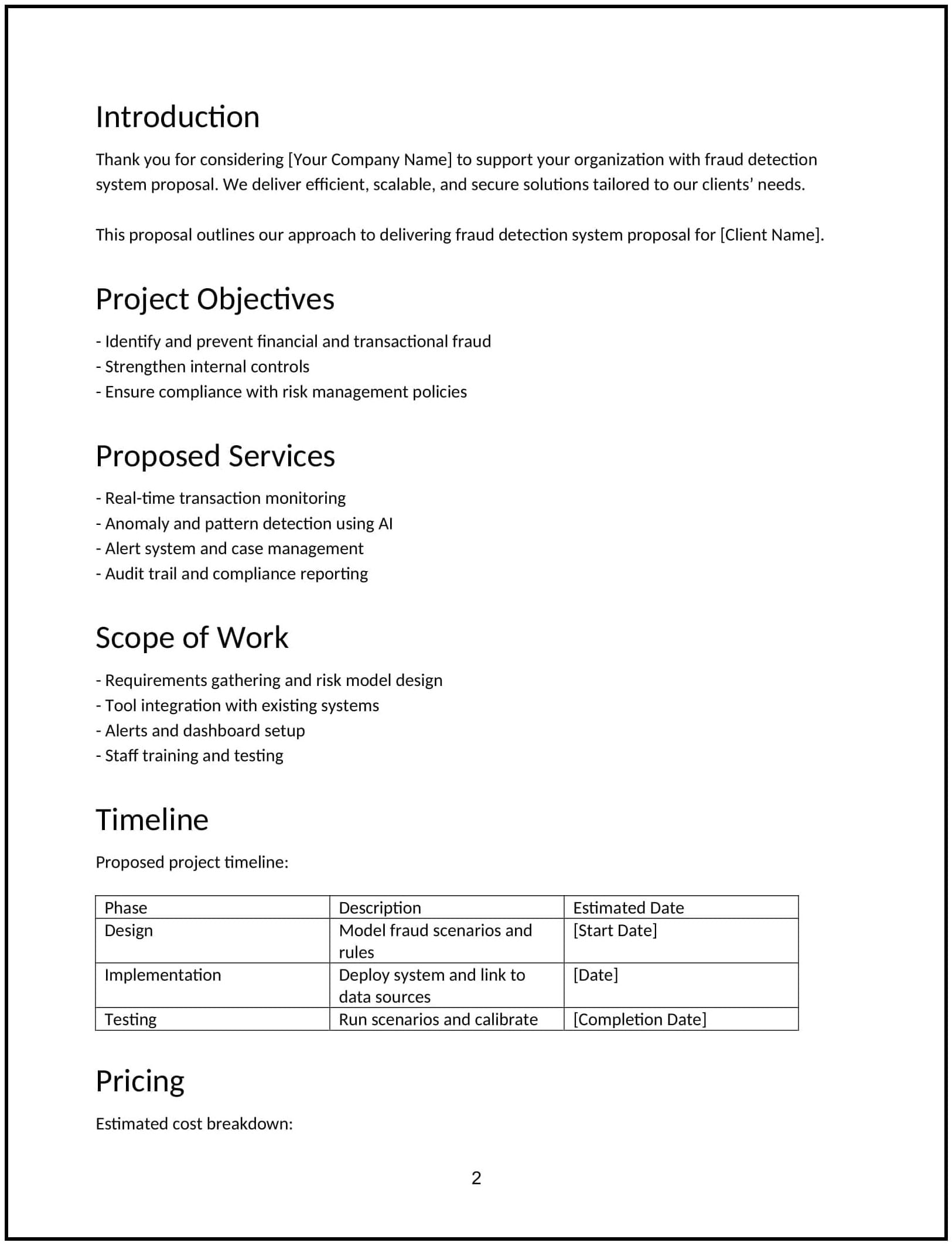

A fraud detection system proposal outlines your plan to identify, flag, and prevent high-risk or suspicious activity using technology, rules, and workflows. It typically includes risk assessment, system design, integration strategy, alert logic, case handling, and reporting infrastructure.

This type of proposal is commonly used:

- When companies need to detect financial, transactional, or account-based fraud

- To prevent chargebacks, false refunds, identity spoofing, affiliate abuse, or internal fraud

- As part of scaling compliance, audit readiness, or payments infrastructure

- When transitioning from manual reviews to rules-based or machine learning models

It helps clients reduce loss, lower manual review burden, and build trust with customers, regulators, and partners.

A strong proposal helps you:

- Define what “fraud” means in their context — and how it shows up in data

- Map current blind spots and recommend structured detection layers

- Build workflows for triage, escalation, and resolution

- Integrate detection with existing platforms, tools, or APIs

Why use Cobrief to edit your proposal

Cobrief helps you move fast without cutting corners — with clean formatting, smart structuring, and in-browser AI writing support.

- Edit the proposal directly in your browser: No copy-pasting or design hassle — just write and structure in real time.

- Rewrite sections with AI: Instantly adapt tone for risk teams, engineers, or execs.

- Run a one-click AI review: Let AI flag vague logic, missing deliverables, or scope confusion.

- Apply AI suggestions instantly: Accept edits line by line or apply all changes across the doc.

- Share or export instantly: Send your proposal via Cobrief or download a polished PDF or DOCX version.

You’ll produce a proposal that reads sharp, lands clearly, and closes faster.

When to use this proposal

Use this fraud detection system proposal when:

- A company is seeing rising chargebacks, suspicious activity, or transaction abuse

- They want to move from manual fraud checks to automation or scoring

- You’re building or improving detection infrastructure inside a payments, marketplace, or fintech business

- Their current detection setup is too noisy, slow, or easily bypassed

- They need to demonstrate fraud prevention maturity to banks, investors, or regulators

It’s especially useful when internal teams lack capacity to map the problem clearly or design a scalable system.

What to include in a fraud detection system proposal

Use this template to walk the client through how you’ll design and deliver a system that flags fraud early, reduces false positives, and drives real action.

- Project overview: Frame the problem — rising fraud losses, manual review fatigue, audit pressure — and how your system addresses it.

- Risk categories: Define the types of fraud you’ll focus on — e.g., payment, refund, identity, promotion abuse, account takeover.

- Detection methods: Outline detection layers — rule-based triggers, pattern recognition, velocity checks, behavioral heuristics, or machine learning models.

- Data sources: Identify what feeds the system — payment logs, user events, IP/location data, device info, CRM activity, etc.

- System design: Describe the detection engine, scoring logic, risk thresholds, and escalation flow.

- Integration points: Clarify how detection hooks into platforms — via API, webhook, event stream, or batch job.

- Alert handling: Detail what happens when a case is flagged — who reviews it, how it’s prioritized, and what actions can be taken.

- Reporting: Offer dashboards, fraud case logs, resolution tracking, and risk summaries for compliance or internal use.

- Timeline and phases: Break into discovery, logic design, implementation, testing, and post-launch optimization.

- Pricing: Offer a clear model — fixed fee for setup, per-risk-category pricing, or ongoing support retainer.

- Next steps: End with a clear CTA — such as booking a data review call, sharing access, or confirming scope.

How to write an effective fraud detection system proposal

This proposal should feel technical, risk-aware, and business-aligned — especially for teams with real exposure and limited tolerance for noise or downtime.

- Focus on clarity: The detection system must be easy to understand, even if technically complex. Make logic transparent.

- Tailor to the business model: A SaaS product’s risks are different from a marketplace or fintech — anchor your scope accordingly.

- Frame automation as efficiency, not infallibility: Emphasize that you’re reducing manual volume while still enabling human review.

- Offer optional depth: If you're using ML, show your logic in stages — but don’t lead with complexity unless they’re ready.

- Reinforce auditability: Show how your system will generate logs, metrics, and evidence to prove prevention efforts work.