Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free M&A due-diligence proposal with Cobrief

Open this free M&A due-diligence proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on deal size, buyer/seller type, industry, and jurisdiction. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching diligence support to acquirers, investors, or operators involved in M&A transactions. Whether you’re managing the full process or focusing on financial, legal, or operational workstreams, this version gives you a structured head start and removes the guesswork.

What is an M&A due-diligence proposal?

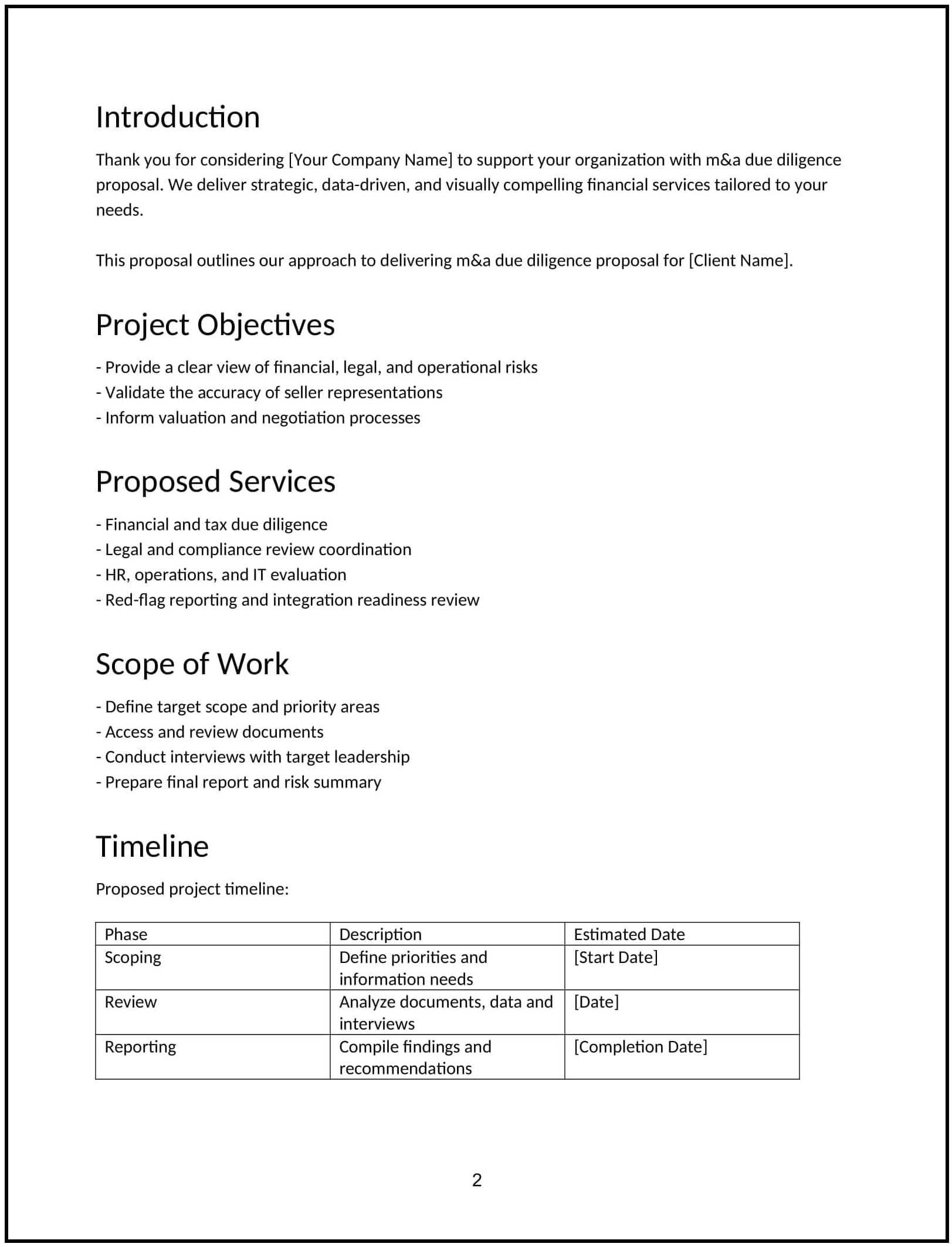

An M&A due-diligence proposal outlines your plan to evaluate a target company’s financial, legal, operational, and strategic risks ahead of a potential acquisition or investment. It typically includes scope, timelines, data request processes, reporting methods, and issue escalation.

This type of proposal is commonly used:

- When a company, fund, or buyer is considering acquiring another business

- Ahead of LOI finalization, during exclusivity, or pre-closing

- For carve-outs, full acquisitions, strategic investments, or acqui-hires

- To surface deal risks before negotiations are finalized

It helps clients identify red flags, confirm assumptions, and reduce post-close surprises.

A strong proposal helps you:

- Define the specific workstreams you’ll cover (e.g., financials, HR, legal, IP, tax)

- Map deliverables to deal stage and decision-making needs

- Set expectations for access, turnaround time, and communication cadence

- Present findings clearly, with decision-oriented recommendations

Why use Cobrief to edit your proposal

Cobrief helps you create a clean, professional proposal quickly — without wasting cycles on formatting or back-and-forth edits.

- Edit the proposal directly in your browser: Structure, draft, and iterate without toggling tools.

- Rewrite sections with AI: Instantly shift tone for private equity teams, founders, or corp dev leads.

- Run a one-click AI review: Let AI flag vague deliverables, unclear scope, or formatting inconsistencies.

- Apply AI suggestions instantly: Accept line-by-line edits or revise the entire draft in one step.

- Share or export instantly: Send via Cobrief or download a polished PDF or DOCX version.

You’ll go from rough draft to delivery-ready without losing momentum.

When to use this proposal

Use this M&A due-diligence proposal when:

- A client is considering acquiring or investing in another business

- You’re supporting an internal corp dev team, external buyer, or investor

- The transaction is moving into exclusivity or needs confirmatory diligence

- A deal has material financial, legal, or regulatory complexity

- The acquirer lacks bandwidth or in-house expertise to run full diligence

It’s especially useful when a fast-moving deal needs structured, credible diligence within a short time frame.

What to include in an M&A due-diligence proposal

Use this template to walk the client through your process — from kickoff to findings — in structured, decision-ready language.

- Project overview: Summarize the context of the deal and the role your diligence will play in supporting the client’s decision.

- Scope of review: Define what’s in scope — financials, contracts, litigation, IP, HR, tech, compliance, tax — and what’s out.

- Document request and data access: Explain how you’ll request, track, and organize access to the target company’s information.

- Key workstreams: Break down responsibilities — who’s leading financial modeling, legal review, compliance checks, etc.

- Risk flagging and escalation: Show how material issues will be flagged in real time, not buried in end-stage memos.

- Deliverables: List outputs — risk matrices, issue summaries, financial analyses, red flag memos, integration notes (if scoped).

- Timeline and phases: Break into phases — kickoff, early findings, deep dive, final report — with expected durations for each.

- Communication plan: Set cadence for check-ins, reporting format, and final debriefs. Clarify access expectations with target company.

- Pricing: Offer clear pricing — fixed fee, hourly cap, or per-workstream. Include optional add-ons like post-close integration support.

- Next steps: End with a clear CTA — such as signing an NDA, confirming access to the data room, or scheduling the kickoff.

How to write an effective M&A due-diligence proposal

This proposal should feel structured, fast-moving, and risk-aware — especially for buyers navigating deal timelines or investor pressure.

- Be clear about what’s in and out of scope: Ambiguity leads to gaps. Buyers hate surprises.

- Tailor by deal stage: Use lighter review structures pre-LOI and more detailed scopes post-exclusivity.

- Flag real-world outcomes: Emphasize that you’ll identify deal-breakers, pricing adjustments, or post-close liabilities.

- Show speed and structure: Acquirers want fast answers — offer lightweight early reads before full reports.

- Avoid bloat: Clients don’t want a 100-page memo — they want confidence and actionable risk calls.