Payroll processing outsourcing proposal: Free template

Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free payroll processing outsourcing proposal with Cobrief

Open this free payroll processing outsourcing proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on client size, jurisdictions, workforce complexity, and platform preferences. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching payroll management services to finance, HR, or operations leaders at startups, mid-sized companies, or nonprofits. Whether you’re replacing an in-house process or a legacy vendor, this version gives you a structured head start and removes the guesswork.

What is a payroll processing outsourcing proposal?

A payroll processing outsourcing proposal outlines your plan to take over a company’s payroll operations — ensuring timely, accurate payments and full compliance with local, state, and federal regulations. It typically includes onboarding, pay cycle execution, tax filing, system integration, compliance handling, and reporting.

This type of proposal is commonly used:

- When companies outgrow manual payroll or spreadsheets

- To replace a legacy payroll provider with poor support or compliance gaps

- When HR or finance teams are stretched thin and want to reduce operational load

- As part of broader finance or HR system modernization

It helps clients reduce risk, save time, and ensure employees are paid correctly — without having to manage payroll in-house.

A strong proposal helps you:

- Outline how payroll will run from intake to payout

- Clarify responsibilities, deadlines, and points of contact

- Address edge cases like bonuses, terminations, garnishments, and multi-state filings

- Reduce the risk of penalties, missed payments, or tax misfilings

Why use Cobrief to edit your proposal

Cobrief helps you build a sharp, clear proposal without wasting time formatting or rewriting.

- Edit the proposal directly in your browser: No juggling between Word docs or email drafts — just open, write, and adjust.

- Rewrite sections with AI: Instantly tailor your tone for HR teams, finance leads, or founders.

- Run a one-click AI review: Let AI flag unclear deliverables, vague pricing, or workflow gaps.

- Apply AI suggestions instantly: Accept edits line by line or revise the entire proposal in one click.

- Share or export instantly: Send the final version via Cobrief or download a polished PDF or DOCX file.

You’ll move from draft to delivery-ready faster — with less overhead.

When to use this proposal

Use this payroll processing outsourcing proposal when:

- A company wants to offload payroll to reduce manual work or avoid compliance mistakes

- Internal teams are managing payroll in-house and struggling with accuracy or timeliness

- You’re offering bundled services (e.g., payroll + HRIS + benefits) or replacing a slow/expensive legacy provider

- The client is entering new states, hiring international contractors, or preparing for growth

- There’s pressure to improve audit readiness or clean up past payroll issues

It’s especially useful when clients are scaling quickly but don’t have the back-office infrastructure to match.

What to include in a payroll processing outsourcing proposal

Use this template to walk the client through your payroll services — from onboarding to pay runs — in a clear, structured format.

- Project overview: Explain why outsourcing payroll makes sense now and how you’ll simplify their pay cycles while reducing risk.

- Scope of services: Define what’s included — payroll processing, tax filing, compliance updates, off-cycle runs, year-end filings (e.g., W-2, 1099), and reporting.

- Platform and tools: Note whether you’ll use the client’s platform (e.g., Gusto, ADP, Paychex) or manage everything through your preferred system.

- Onboarding and setup: Outline the first steps — data migration, approvals, historical payroll validation, and access setup.

- Pay run process: Describe how pay runs work — deadlines, approvals, corrections, gross-to-net calculation, and direct deposit timing.

- Tax compliance: Clarify how federal/state/local tax filings, wage garnishments, and notice handling are managed.

- Edge case handling: Address bonuses, retro pay, new hires, terminations, PTO payouts, international contractors, and fringe benefits if applicable.

- Reporting and audit support: Include monthly summaries, YTD views, and support during audits or 401(k) testing.

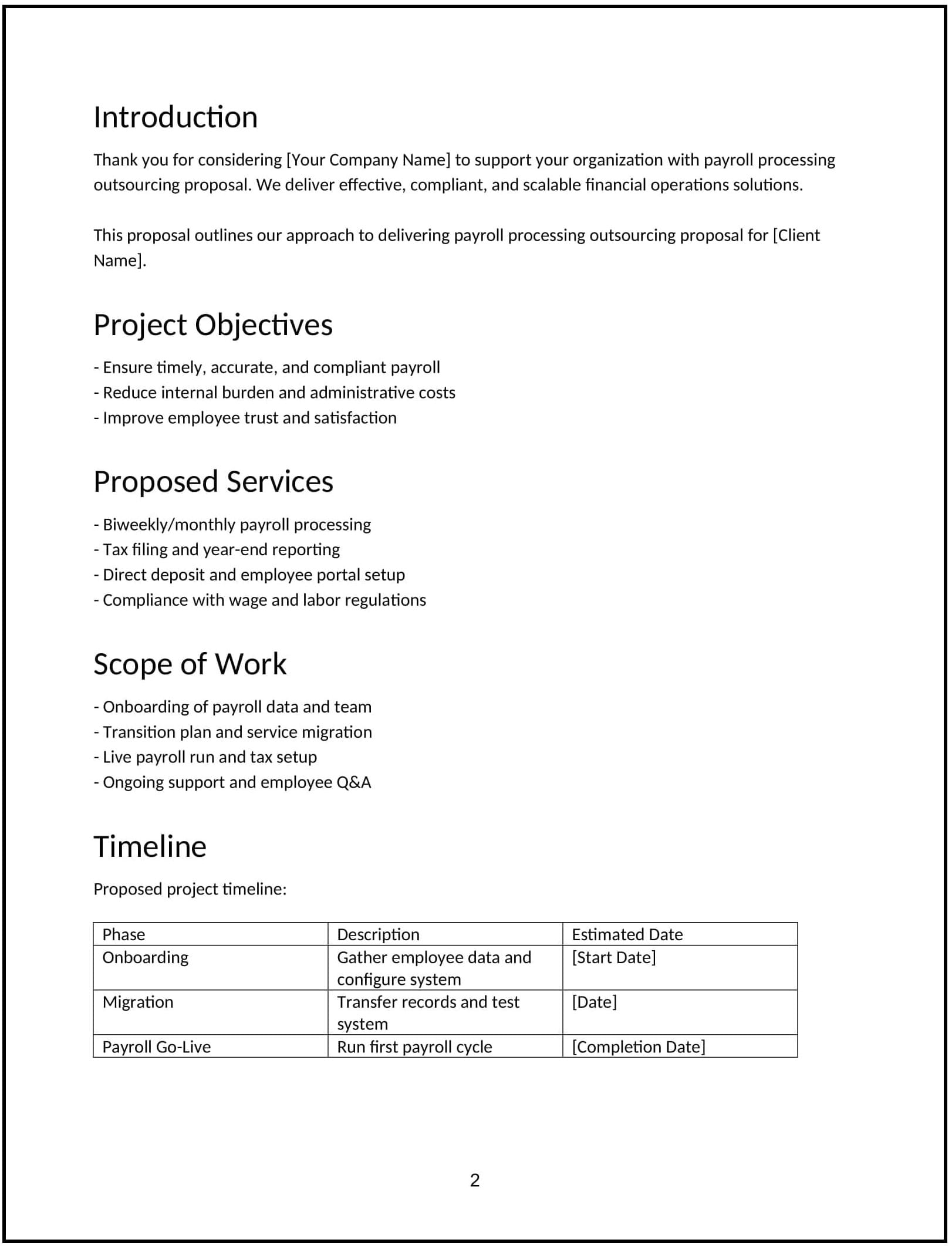

- Timeline and milestones: Break the project into onboarding, first pay run, stabilization, and ongoing support — with duration estimates.

- Pricing: Offer a clear structure — per pay run, per employee per month (PEPM), or fixed monthly tiers. Include optional add-ons (e.g., time tracking, PTO management).

- Next steps: End with a clear CTA — such as granting access, sharing employee data, or scheduling onboarding.

How to write an effective payroll processing outsourcing proposal

This proposal should feel operational, dependable, and low-friction — especially for clients overwhelmed by complexity or past vendor failures.

- Lead with clarity: Make your role, deliverables, and deadlines crystal clear — don’t let scope feel ambiguous.

- De-risk the handoff: Emphasize how you’ll transition smoothly and catch errors before they hit payroll.

- Make compliance feel handled: Most clients just want confidence that taxes, filings, and deadlines are covered — spell this out.

- Offer flexibility, not chaos: Show how your workflows can accommodate bonuses, PTO, or last-minute edits — without becoming unmanageable.

- Stay tool-agnostic (unless needed): If you work with multiple platforms, list supported tools and offer advice — but don’t force a migration unless scoped.