Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free R&D tax credit analysis proposal with Cobrief

Open this free R&D tax-credit analysis proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on the client’s industry, funding stage, and documentation readiness. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching R&D tax credit services to CFOs, controllers, or founders of tech companies, manufacturers, or scientific orgs. Whether you’re offering a full-service study or just eligibility validation, this version gives you a structured head start and removes the guesswork.

What is an R&D tax credit analysis proposal?

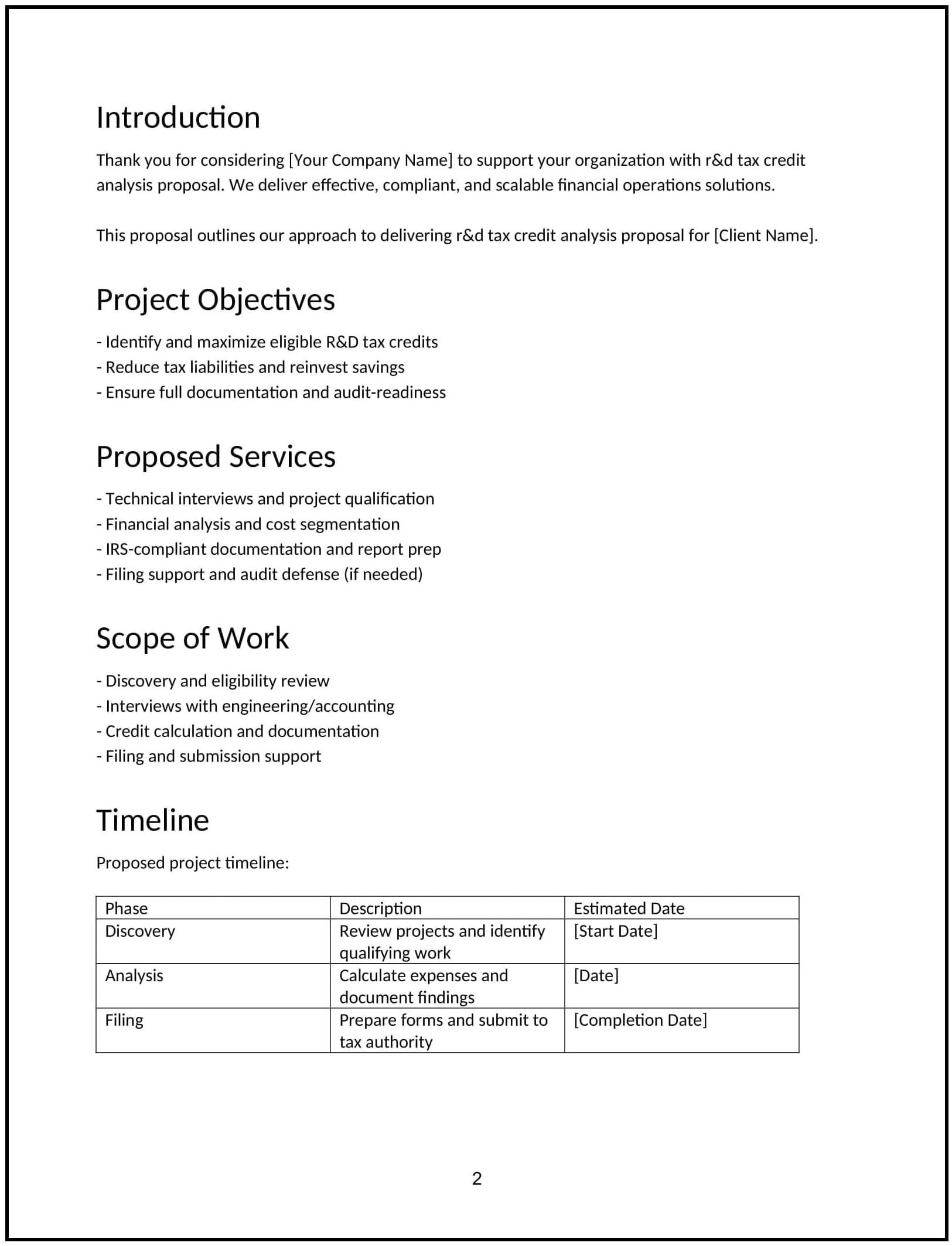

An R&D tax credit analysis proposal outlines your plan to identify, quantify, and support the submission of qualified research expenses (QREs) under federal or state R&D tax credit programs. It typically includes eligibility analysis, cost tracking, substantiation strategy, documentation prep, and IRS or state filing coordination.

This type of proposal is commonly used:

- When companies are unsure whether they qualify for the credit

- To help pre-revenue or early-stage startups access payroll-based credits

- Ahead of tax season or a financial audit

- As part of proactive tax planning to reduce effective tax rates

It helps companies capture valuable incentives while reducing audit risk and internal burden.

A strong proposal helps you:

- Identify which roles, activities, and expenses qualify under IRS criteria

- Build a compliant documentation trail to support the claim

- Maximize the benefit while minimizing risk

- Coordinate directly with CPAs or tax firms to handle the filing

Why use Cobrief to edit your proposal

Cobrief helps you write sharp, structured proposals quickly — without the formatting pain or content guesswork.

- Edit the proposal directly in your browser: No toggling between tools — just write, refine, and preview live.

- Rewrite sections with AI: Tailor tone instantly for founders, CFOs, or tax advisors.

- Run a one-click AI review: Let AI catch scope gaps, vague language, or unnecessary complexity.

- Apply AI suggestions instantly: Accept edits line by line or apply improvements across the proposal.

- Share or export instantly: Send via Cobrief or download a clean PDF or DOCX version in one click.

You’ll go from notes to client-ready without stalling in draft mode.

When to use this proposal

Use this R&D tax credit analysis proposal when:

- A company wants to explore eligibility for the federal or state credit

- A startup is doing product development and has qualifying payroll expenses

- You’re offering audit-proof substantiation support ahead of tax filing

- A client needs help documenting technical roles and activities in plain-English

- You’re replacing a legacy firm that didn’t provide enough transparency or support

It’s especially useful when clients don’t know what qualifies or assume they’re too early to benefit.

What to include in an R&D tax credit analysis proposal

Use this template to walk the client through your process — from eligibility review to final claim support — in clear, practical terms.

- Project overview: Explain the opportunity — what the R&D credit covers, who qualifies, and why it matters now.

- Eligibility analysis: Outline how you’ll assess their activities, roles, and cost centers against IRS four-part test or state criteria.

- Qualifying expense categories: List the types of expenses you’ll review — payroll, contractor costs, cloud infrastructure, materials, etc.

- Documentation process: Describe how you’ll gather support — interviews, time-tracking, project descriptions, payroll data, and internal reports.

- Credit calculation: Show how you’ll quantify QREs and apply the correct method (regular or alternative simplified credit).

- Filing and coordination: Clarify how you’ll support the client’s CPA or handle Form 6765 and any state filings directly.

- Risk management: Explain how you’ll prepare for audit readiness — with workpapers, narratives, and third-party support if challenged.

- Timeline and phases: Break the work into phases — discovery, documentation, calculation, review, filing support — with duration estimates.

- Pricing: Offer a flat fee, hourly rate, or contingency-based pricing. If you use contingent pricing, clarify audit support terms.

- Next steps: End with a CTA — such as sending prior returns, sharing payroll reports, or booking a kickoff call.

How to write an effective R&D tax credit analysis proposal

This proposal should feel expert, credible, and easy to move forward on — especially for teams unsure how the credit works.

- Keep language simple: Most clients don’t know IRS criteria — translate it into real examples and job functions.

- Emphasize audit-readiness: Risk is the main objection — lead with how you build defensible files.

- Clarify your scope: Be precise about what’s included — analysis, documentation, calculations — and what goes to the CPA or tax preparer.

- Offer flexibility: Many clients aren’t sure how much they’ll qualify for — offer both fixed-fee and contingent options if possible.

- Tailor by industry: Use language relevant to software dev, biotech, manufacturing, or other verticals depending on the client.