SAFE/convertible note investment proposal: Free template

Customize this free SAFE/convertible note investment proposal with Cobrief

Open this free SAFE/convertible note investment proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on your raise size, investor type, and deal terms. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for summarizing early-stage investment opportunities under a SAFE or convertible note. Whether you’re raising pre-seed or bridging to Series A, this version gives you a clean, professional way to communicate your deal and keep investor momentum.

What is a SAFE/convertible note investment proposal?

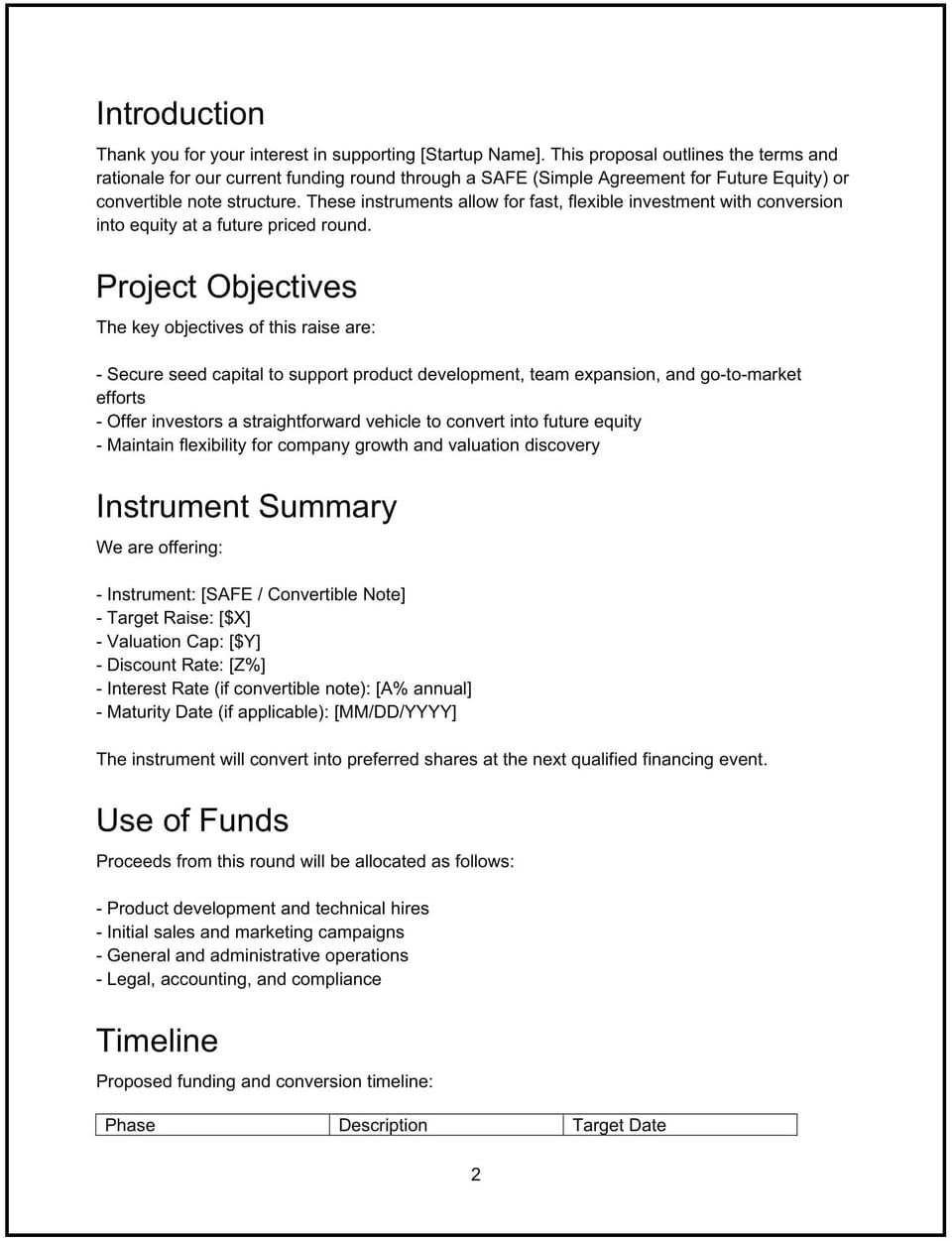

A SAFE/convertible note investment proposal is a document used to present the terms of an early-stage investment round using a non-equity instrument — typically a SAFE (Simple Agreement for Future Equity) or a convertible note. It outlines your raise details, valuation cap, discount, and timeline in plain terms for potential investors.

Usually sent after a pitch call or deck review, this proposal helps investors quickly understand the structure of the deal and what their participation would look like.

A strong proposal helps you:

- Formalize your raise terms without needing a full-priced equity round

- Build investor confidence with clarity and structure

- Speed up soft commits and legal review

- Keep conversations moving toward conversion or signature

Use this proposal to summarize your round and provide next steps — without overwhelming with legal docs upfront.

Why use Cobrief to edit your proposal

Cobrief lets you turn investment terms into a structured, investor-friendly proposal — with built-in AI tools to tighten language and polish your message.

- Edit the proposal directly in your browser: No templates or deck builders needed

- Rewrite sections with AI: Adjust tone, clarify terms, or tighten pitch language

- Run a one-click AI review: Spot gaps in the flow or unclear financial terms

- Apply AI suggestions instantly: Accept individual edits or apply them all in one click

- Share or export instantly: Send via Cobrief or export as a clean PDF or DOCX file

Spend less time formatting and more time closing the round.

When to use this proposal

This SAFE/convertible note investment proposal works best in situations like:

- Following up after a pitch meeting: Clarify your round terms and invite participation

- Formalizing a rolling close: Keep warm investors engaged with a clear write-up

- Preparing for a bridge round: Frame the opportunity for existing or friendly investors

- Running a founder-led raise without bankers or formal processes

- Including deal terms in investor updates or LP memos

Use this whenever you want to move from interest to intent — without relying solely on email threads or deck links.

What to include in a SAFE/convertible note investment proposal

This template gives investors the context they need to evaluate and act. Here’s how to structure it:

- Executive summary: 1–2 lines on what the company does, traction to date, and the core reason to invest now (e.g., “$30k MRR, just signed 3 enterprise logos, raising to accelerate sales”).

- Raise overview: Detail your raise size (e.g., $500K on SAFE), round structure (SAFE or convertible note), valuation cap, discount (if any), and target close date. Mention whether it’s a rolling close or has a hard deadline.

- Use of funds: Briefly outline how the money will be deployed — e.g., “Hire 2 engineers, scale paid acquisition, extend runway to Series A.”

- Deal structure: Explain SAFE vs. note in plain terms if needed. For notes, include interest rate, maturity date, and conversion triggers.

- Ownership and dilution: Optional — share post-money SAFE mechanics or note conversion expectations, especially if modeling dilution.

- Next steps: Invite action — e.g., “Reply to confirm interest,” “We’ll send the SAFE via DocuSign,” or “Access our data room and cap table here.”

How to write an effective SAFE/convertible note investment proposal

This proposal is about speed, clarity, and confidence. Here’s how to make it effective:

- Make the raise terms impossible to misread: Cap, discount, instrument, close date — all up front.

- Cut the fluff: Investors don’t need another pitch — they want to know the deal.

- Use plain English: Especially if you’re raising from angels or non-institutional investors.

- Give just enough context: A few numbers, team highlights, or market proof points are all you need here.

- Show momentum: Mention committed capital or soft circle progress if you have it.

- Include a CTA: Always give them a clear next step — the more frictionless, the better.

Frequently asked questions (FAQs)

Is this proposal a legal document?

No — this is a summary. You’ll still need to send an actual SAFE or convertible note for signature.

What’s the difference between a SAFE and a convertible note?

A SAFE is a simpler investment agreement without interest or a maturity date. Convertible notes accrue interest and convert at a future financing or maturity trigger.

What if I haven’t decided on a valuation cap yet?

You can include a placeholder or range (e.g., “Targeting a $5M–$6M cap”) and follow up with final docs.

Can I include this proposal in my investor update?

Yes — just make sure to tailor the executive summary and next steps for your audience.

Can I download and send this as a PDF?

Yes — Cobrief lets you export this as a clean, professional PDF or DOCX file after editing.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.