Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free tax preparation proposal with Cobrief

Open this free tax preparation proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on your tax services, client type, and jurisdiction. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching individual, small business, or corporate tax return preparation. Whether you specialize in compliance, deductions, multi-state filings, or planning, this version gives you a structured head start and removes the guesswork.

What is a tax preparation proposal?

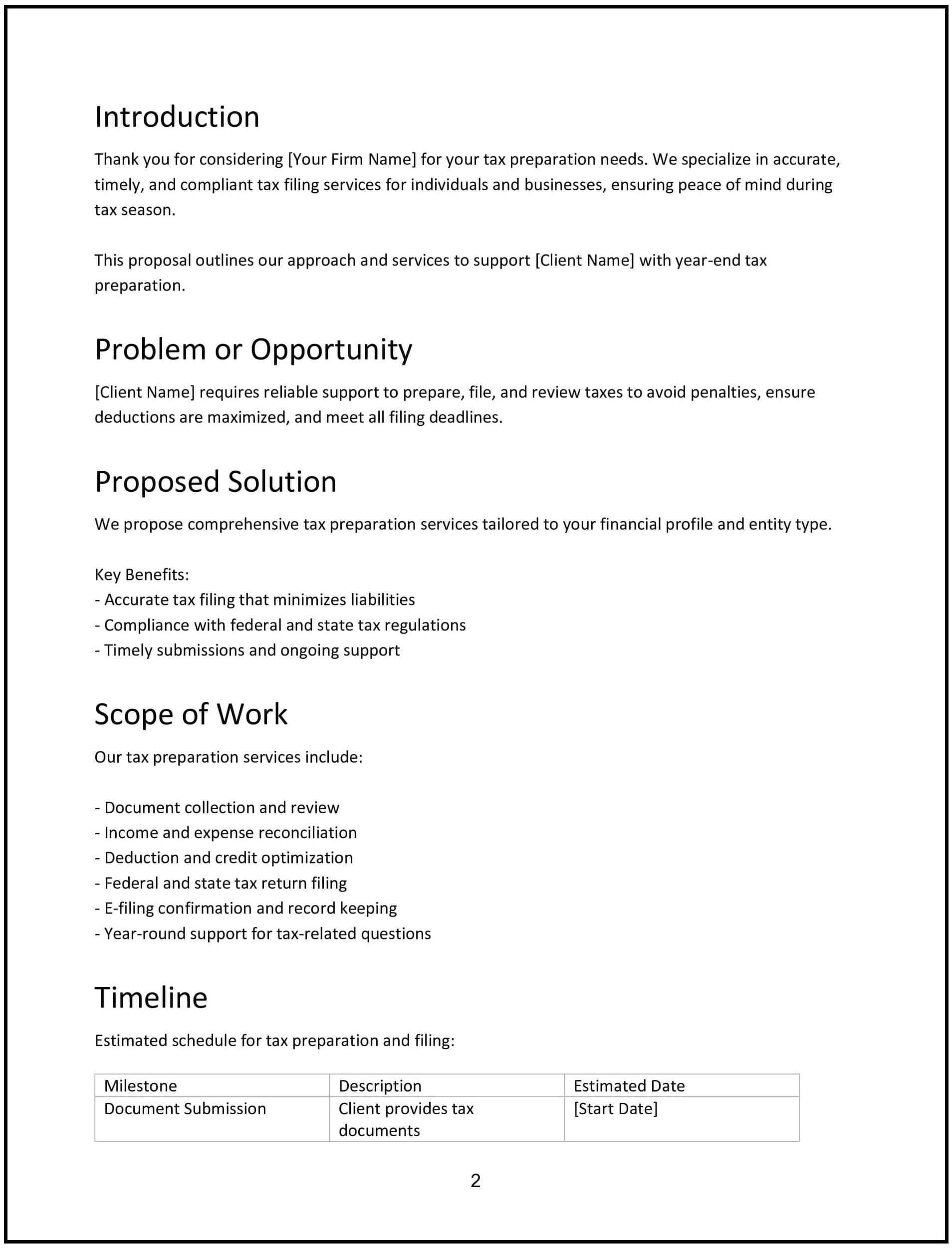

A tax preparation proposal outlines how you’ll help a client gather, review, and file their taxes accurately and on time. It typically includes the type of return, filing requirements, documentation needed, process steps, deadlines, and pricing.

This proposal provides clarity around what’s covered and what to expect — while establishing trust and professionalism upfront.

A strong tax prep proposal helps you:

- Define the scope of tax work clearly

- Set expectations for timeline and communication

- Reduce confusion and missed filings

- Build client confidence in your expertise

Why use Cobrief to edit your proposal

Cobrief lets you build and polish your tax prep proposals quickly — with built-in AI that helps improve every section.

- Edit the proposal directly in your browser: No templates or formatting needed.

- Rewrite sections with AI: Clarify IRS terms, simplify tax jargon, or adjust tone instantly.

- Run a one-click AI review: Spot unclear or redundant areas and improve them instantly.

- Apply AI suggestions instantly: Accept edits individually or apply all at once.

- Share or export instantly: Send via Cobrief or download a clean PDF or DOCX file.

Deliver clear, compliant proposals with speed and precision.

When to use this proposal

Use this tax preparation proposal for:

- Preparing personal or business tax returns (federal, state, or local).

- Offering ongoing tax support to individuals or small businesses.

- Managing multi-entity or multi-state filings.

- Responding to tax preparation RFPs.

- Pitching catch-up or amended return services.

It works for both recurring clients and one-off filing engagements.

What to include in a tax preparation proposal

Each section helps the client understand your service, how it works, and what they need to provide:

- Executive summary: Explain what tax prep services you’re offering and how they’ll help the client stay compliant, maximize deductions, and reduce stress.

- Scope of work: Define what’s included — federal and state return preparation, business filings, self-employment income, 1099 reporting, deductions, credits, estimated payments, amended returns, or multi-state support.

- Process and timeline: Outline key dates and your steps — document collection, review, preparation, client approval, filing, and post-filing support. Include deadlines for input and sign-off.

- Documentation needed: List the documents you’ll need from the client (e.g., W-2s, 1099s, prior year returns, business expenses, depreciation schedules).

- Pricing: Present your fees — flat-rate per return, hourly, or bundled. Clearly state what’s included and any add-on services like audit protection or tax planning.

- Terms and conditions: Cover confidentiality, data security, payment terms, communication expectations, and client responsibilities.

- Next steps: End with a clear CTA — like “Reply to confirm,” “Upload your tax documents,” or “Schedule a kickoff call.”

How to write an effective tax preparation proposal

This proposal should feel precise, trustworthy, and reassuring:

- Focus on clarity and peace of mind: Clients want to avoid surprises and penalties

- Use plain language: Avoid complex tax terms unless absolutely needed

- Show process transparency: Help clients feel guided through each step

- Be upfront about pricing: No hidden fees — transparency builds trust

- Format cleanly: Use short paragraphs, bulleted lists, and clear sections

- Guide next steps: Make it easy to start the engagement